Gold has been a symbol of wealth and prosperity for centuries. Whether it's in the form of intricate jewellery, coins, or investment bars, gold continues to captivate investors and enthusiasts alike. One of the most sought-after forms of gold is the gold bar, which is widely used for investment purposes. But what determines the price of a gold bar ? Let's explore the key factors that influence gold bar prices and how they fluctuate in the market.

Factors Affecting the Price of a Gold Bar

1. Market Price of Gold

The primary determinant of a gold bar’s price is the current market price of gold, also known as the spot price. This price fluctuates daily based on supply and demand in the global commodities market. The spot price of gold is usually quoted per troy ounce (approximately 31.1 grams).

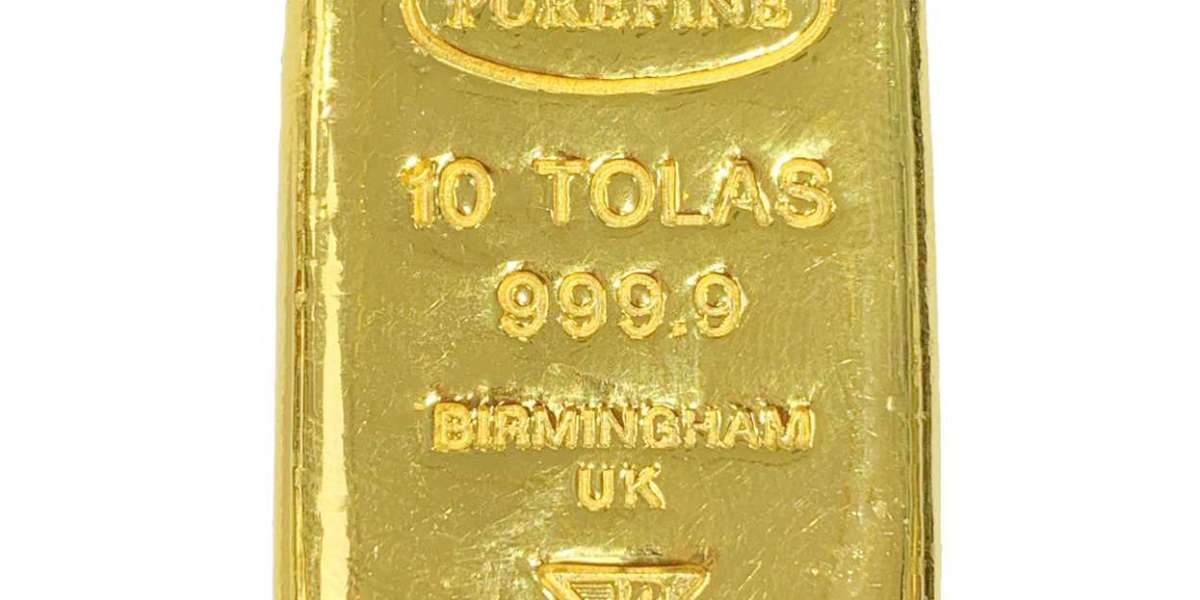

2. Weight and Purity

Gold bars come in various weights, from as small as 1 gram to as large as 1 kilogram or more. The heavier the gold bar, the higher its price. Additionally, the purity of the gold plays a role in pricing. Most gold bars have a purity of 99.99%, commonly referred to as 24-karat gold.

3. Economic and Political Stability

Gold is often considered a safe-haven asset, meaning its price tends to rise during economic uncertainty. Events like inflation, stock market volatility, and geopolitical tensions can lead to an increase in gold prices, affecting the cost of gold bars.

4. Supply and Demand

The availability of gold in the market influences its price. If mining production slows down or central banks increase their gold reserves, prices may rise. Conversely, if supply increases and demand decreases, the price of gold bars can drop.

5. Manufacturing and Brand Premiums

Gold bars are produced by various refineries, and some brands, such as PAMP, Credit Suisse, and Perth Mint, command higher premiums due to their reputation and quality assurance. Investors often pay extra for well-known brands that offer guaranteed authenticity.

6. Taxes and Import Duties

In some countries, the price of a gold bar is influenced by taxes, import duties, and other regulatory fees. Before purchasing a gold bar, it’s crucial to check the tax policies in your region to determine the final cost.

How to Track Gold Bar Prices?

To stay updated on the price of a gold bar , investors can check financial news websites, stock market reports, and gold trading platforms. Many online dealers and bullion retailers provide real-time gold price updates, helping buyers make informed decisions.

Final Thoughts

The price of a gold bar is influenced by multiple factors, from global economic trends to brand premiums. Whether you are an investor or a collector, understanding these factors will help you make smart decisions when buying or selling gold bars. Always compare prices from different sources and consider storage and security options before making a purchase.

Investing in gold bars can be a rewarding venture, but staying informed about market trends is key to making profitable decisions. Keep an eye on the price of gold, and you may find the perfect opportunity to invest in this timeless asset

Visit Us : https://www.a1mint.com/